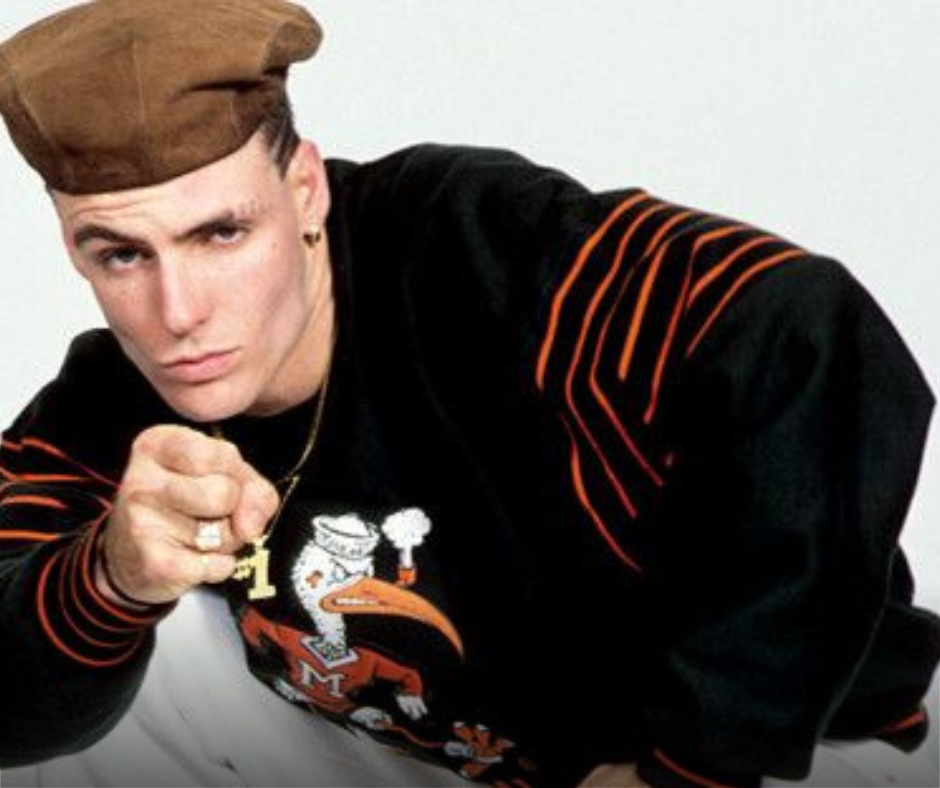

This week, we’re continuing to look at the lives of 4 celebrities and how they’re preparing for the inevitable (or didn’t!). Last week, we examined Michael Jackson’s planning and the holes in his plan that resulted in his family being embroiled in court and conflict for 15 years and counting (if you missed it, go back and check it out!). In this second article of our 4-part celebrity series, Vanilla Ice chimes in with his estate planning experience, advice, and lessons learned on a video he posted to his YouTube channel. He has a lot to say! I’ll share some comments users posted with their takeaways, and I’ll pull out a few lessons that we can learn, too.

Let’s start with a topic no one likes to talk about: taxes.

Vanilla Ice (Really) Hates Estate Taxes

Vanilla Ice shares the story of his buddy Mark, whose parents owned a sprawling property in Palm Beach, Florida. When they passed, Mark and his siblings sold the estate, expecting to be set for life. But estate taxes ended up taking over 80% of their profit. Ouch.

Vanilla Ice calls this tax a “generational wealth killer,” and he’s not wrong. Estate taxes can sneak up and bite a huge chunk out of your wealth. And the thing is, with a proper estate plan, this doesn’t have to happen! The key is to educate yourself. Knowing what you’re up against helps you plan smarter so that more of your hard-earned assets reach your heirs.

In the comments section of the video, one user wrote that he agrees. He says, “as a Certified Public Accountant (CPA), I love Rob’s recommendation to gain an understanding of taxes. We spend more on taxes than everything else in life.”

So, first lesson: if you suspect your family could pay estate taxes at the time of your death, don’t wait to plan. There’s way too much at stake.

Let’s talk life insurance next.

Life Insurance

Life insurance isn’t just for covering funeral costs – it’s a secret weapon in estate planning. Vanilla Ice suggests “maxing out your life insurance” to pass on as much money to your kids as you can. What makes life insurance “cool” is that death benefits aren’t subject to income tax, meaning your heirs can get more bang for your buck than if you were investing the money you’d put into life insurance premiums into just about any other asset class.

It’s worth considering what Vanilla Ice suggests here. When you take out a life insurance policy, the payout can cover any necessary taxes, probate fees, and debts, ensuring your heirs receive the lion’s share of your assets. Life insurance can help with short-term needs, like paying off a mortgage, or it can serve your family’s long-term needs, like maintaining the lifestyle to which they’re accustomed.

Second lesson: If you want to be cool, make the right type and kind of life insurance part of your planning.

Ice Says Trusts Are Not Just for the Rich and Famous (and He’s Right!)

Trusts might sound like something only the super-wealthy need, but they’re a smart tool for anyone looking to protect their assets. One commenter agreed, saying he’s learned this from experience, “It isn’t just millionaires that need planning. I’ve seen families torn apart fighting over $100,000 or less. Siblings not speaking to each other again over $50,000.”

Ice mentions irrevocable trusts specifically. These types of trusts let you transfer assets to a beneficiary while removing the assets from your taxable estate, ensuring your assets aren’t subject to estate taxes. Any assets placed in an irrevocable trust are also protected from legal judgments and creditors IF you do it the right way and in the right jurisdiction. Don’t go at this one alone. But if it’s something you are interested in, contact us and let’s talk. In the video, Ice jokes about putting his classic car collection into a trust and setting rules, such as his kids can lease but not sell the cars. This kind of protection ensures your heirs benefit from, but don’t squander, the assets. In other words, even after death, you get to determine how your assets will be used. And if you want to protect them for future generations, you can. This is one way to create generational wealth.

So now we’re up to our third lesson: If you want to protect and preserve your assets for generations, take Vanilla Ice’s advice and utilize trusts in your planning.

Ice Has Some Not-So-Nice Things to Say About Lawyers

While trusts can undoubtedly be a useful tool in estate planning, Ice has some, let’s say, not-so-nice things to say about some lawyers who draft trusts for their clients. He calls them “vultures.” Yikes. One commenter couldn’t resist throwing in a lawyer joke, saying, “What do you call a 1,000 lawyers @ the bottom of the sea? A good start.”

Believe us when we say, we’ve heard all the lawyer jokes out there, and the reality is, they wouldn’t be “jokes” if people didn’t find them funny. People find them funny because there’s some truth in them. Sadly, lots of people have had a bad experience with a lawyer in the past.

Ice aptly describes what a bad experience looks like: the lawyer confusing you by using complex language and legal concepts, selling you documents you don’t really need, and charging way too much for what the lawyer offers. He warns against blindly trusting lawyers like this.

And, he’s right.

It is exactly why we have the processes in place that we have. Our Life & Legacy Planning process has been developed precisely to ensure you are well-counseled to understand all the decisions you are making, we never put in place documents that we know are likely to fail, and that you choose your own fees through our education process.

Our education first process is designed so you understand enough about how the law works in your unique situation so that you can make wise choices and be your own best advisor first and foremost. Our pricing model is all flat fee, agreed to in advance, no gimmicks, no surprises, and all chosen by you.

This brings us to our fourth and final lesson: hire a lawyer you can trust to be there for you and your family, for life and beyond.

Put Vanilla Ice’s Advice Into Action Today

Vanilla Ice’s video brings forward lessons everyone can benefit from. By understanding your options, including how taxes and life insurance impact your family and assets specifically, and considering the use of well-counseled trusts, you can safeguard your assets and ensure they benefit your loved ones the way you want. To quote his classic hit, “Ice Ice Baby,” ‘Anything less than the best is a felony.’ Take these lessons from Vanilla Ice to heart, and start building a solid estate plan today. Your future generations will thank you for it.

This article is a service of Davidek Law Firm, PLLC. We don’t just draft documents; we ensure that families and business owners make informed and empowered decisions about life and death, for themselves and the people they love.